Last week I wrote about the disparities in pay between rank and file educators and those who work in the offices of NJEA, N.J.’s largest teachers union. There are two parts to today’s post: First, the disparities in annual compensation between teachers and NJEA front office employees extend to disparities in retirement security. Second, there’s a long list of teachers and administrators who, by just about any standard, shouldn’t collect pensions at all and contribute to the insolvency of the New Jersey’s Teacher Pension and Annuity Fund (TPAF); including all pension programs and retiree health benefits, the state has an unfunded liability of about $202 billion.

First let’s look at the inequity between teachers’ reliance on an under-water pension system that is inherently political (governors develop annual state budgets that include pension payments, often bedizened with accounting tricks) and the apolitical retirement security of NJEA leaders who don’t work in schools.

According to the Manhattan Institute, without major reforms NJ educators face a “catastrophic failure” of their pension system that will run out of money sometime between 2027 and 2036. It’s worth noting that back in 2005 Gov. Phil Murphy chaired a “Benefits Review Task Force” and its final report says,”some sacrifices on the part of all stakeholders is reasonable as a way to shore up the finances.” Ralph Caprio of Rutgers writes, “there is no way, without some kind of modification to the pension system, that this state going to be in a position to fund future liabilities. It’s that simple. The numbers are clear.”

But union leaders’ deferred compensation is largely protected. Why? Because they rely not only on defined benefits plans — pensions– but also defined contribution plans, typically 401(K) plans, which John Bury describes as “very well funded.” (An Economic and Fiscal Policy Review Committee headed by Senate President Steve Sweeney recommended that teachers with less than five years experience be moved into defined contributions plans, just like front office employees.)

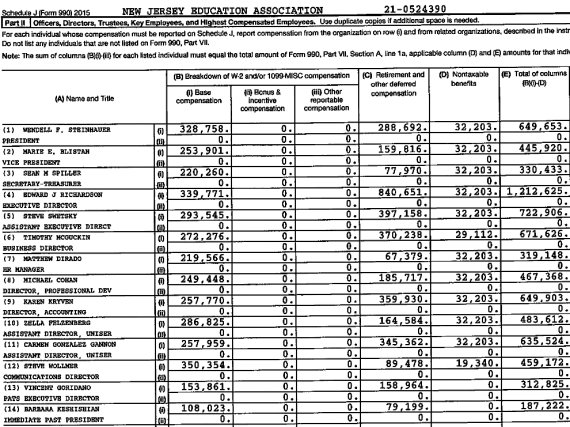

Example: In 2016 NJEA Executive Director Edward Richardson had a base salary of about $340,000. But, according to the 2016 990 IRS form (Schedule J, Part 2), under the column “retirement and other deferred compensation,” Richardson has another $840,641 for a total package of $1,121,625. Bury says that column includes income from defined contribution plans (like 401(K) plans) that teachers don’t have access to.

Fair or unfair?

You call it.

**********************************

Now let’s look at teachers and school employees who are fired for offenses like money laundering, extortion, bribery, perjury, official misconduct, and tampering with public records. They’re not supposed to be able to collect pensions. Last year the NJ Legislature passed Senate Bill 3766 that adds certain sexual offenses to that list. However, a review of state pension data shows that the current standards for removing pensioners have been weakly implemented, draining the pension fund further and harming the deferred compensation of innocent teachers.

Examples:

- TPAF’s pension rolls contain multiple individuals who took “early retirement” immediately after or while being investigated for various types of official misconduct, including bribery, fraud, and test manipulation. In several cases, public records confirm the individual pled guilty to the charges or was found culpable of official misconduct by investigators — and yet these individuals continue to draw state pensions.

- TPAF’s pension rolls contain multiple individuals arrested for sex crimes against children, including rape, child pornography, and failure to report sexual abuse of students. In several cases, public records confirm the individual pled guilty or was found culpable of the wrongdoing in court — and yet these individuals continue to draw state pensions.

Here’s a partial list.

Official Misconduct: Bribery, Fraud, & Test Manipulation

- Gary Vitta took “early retirement” from his position as superintendent of Rockaway Township Schools on December 1, 2011. In 2015, he pled guilty to instructing a witness to lie during a federal investigation into whether he had used his position as superintendent to illegally steer his district’s insurance contracts to brokers in exchange for bribes between 2006 and 2011. According to state pension data, he currently collects an annual pension of $107,932.

- Patricia Johnson took early retirement from her position as a top administrator at H.B. Wilson Elementary School in Camden on August 1, 2006. In March 2007, she was indicted on charges that she had conspired to trick parents and students at her school into paying for outings funded by the district and then pocketed thousands of dollars in resulting proceeds. According to state pension data, she currently collects an annual pension of $44,179.

- Dawn Fidanza took “early retirement” from her position as superintendent of the South Bergen Jointure Commission on January 1, 2018, after a state investigation found she had abused her position by transferring her daughter from one office to another without BOE sign-off and covering security cameras to ensure her daughter would not be seen working at her new job. According to state pension data, she currently collects an annual pension of $127,769.

- Cathie Badowsky took “early retirement” from her position as principal of Woodbridge’s Ford Avenue School 14 on July 1, 2015, after a March 2015 investigation by the DOE’s Office of Fiscal Accountability and Compliance found that she had encouraged cheating during standardized tests. According to state pension data, she currently collects an annual pension of $108,529.

- Lois Rotella took “early retirement” from her position as assistant superintendent of Woodbridge Township on September 1, 2012, following a four-year investigation by the DOE’s Office of Fiscal Accountability and Compliance found she had engaged in “conduct unbecoming a school administrator” by manipulating standardized test results and encouraging teachers to fudge attendance records. According to state pension data, she currently collects an annual pension of $120,626. (Her lawyer said she was “used as a convenient scapegoat by a statewide education system that overemphasizes the importance and need for standardized tests.”)

Sexual Offenses

- Maria Patamia took “early retirement” from her position as a physical education teacher at Mount Olive Middle School on July 1, 2012. In 2016, she was required to register as a sex offender after pleading guilty to sexually abusing a 14-year old girl from her school after school let out for the summer of 1993. According to state pension data, she currently collects an annual pension of $48,410.

- Nicholas Sysock took “early retirement” from his position as a vice principal at Carteret High School on July 1, 2013. On August 15, 2013, he was sentenced to 37 months in prison after pleading guilty to possessing child pornography during his tenure as a vice principal between 2008 and 2012. According to state pension data, he currently collects an annual pension of $44,974.

- Matthew Hoffman was a principal at a Somerset County High School until his early retirement in 2009, which came four months after he was accused of raping a young man while teaching in the Hopewell Valley Regional School District during the 1980s. A jury in a lawsuit against Hoffman found that he had sexually abused the young man and for outings funded by the district and then pocketed thousands of dollars in resulting proceeds. A court awarded the victim $300,000 in 2015. In 2017, a second lawsuit was filed against Hoffman alleging he had sexually assaulted a female student at Hillsborough’s Woodfern Elementary School “on hundreds of occasions” during the 2006-07 school year. According to state pension data, he currently collects an annual pension of $56,936.

- Joseph Ponsi worked for three decades as a guidance counselor at Palisades Park Junior-Senior High School until he took “early retirement” on July 1, 2004. In 2010, he was sentenced to four years probation after being accused by police of transmission and possession of child pornography. According to state pension data, he currently collects an annual pension of $55,753

- Catherine DePaul took “early retirement” from her position as principal of Triton Regional High School on February 1, 2013, after she was arrested in October 2012 for failing to report three teachers at her school for sexually abusing students. She pled guilty to the charges in March 2014. According to state pension records, she currently collects an annual pension of $69,381.

Fair or unfair?

You call it.

2 Comments